WARNING: This may be a bold statement…..

I would ordinarily let it slide, but for the fact it came out of the mouth of Australia’s leading Property Professional.

And I have always learnt, when Michael Yardney speaks, it is always worth a listen.

You see he has a habit of being right on the money with almost all of his property commentary.

Here is what he had to say;

Let’s take a look in more detail…….

From Market Peak until March 2019

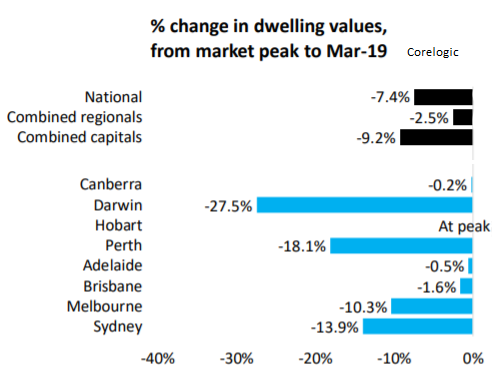

As the numbers highlight, falls for both Sydney and Melbourne have been in the vicinity of 10% - 14% and with Auction clearance rate and buyer activity increasing, most would suggest we have seen the worst.

As Michael suggested, the market has not seen these types of falls since the recession we had to have in the 1990’s, nearly three decades ago.

Not even during the Global financial crisis did property prices fall by as much.

Therefore, as we are entering another property cycle, it presents another opportunity for property investors.

All major hurdles like the election, changes to negative gearing are also now in the rear view mirror, even money is cheaper!

Interest Rates

Interest Rates are also going to remain low.

And recent market commentary would suggest they could even go lower in the short term.

So money has never been cheaper and it will stay that way.

There was some interesting discussions recently highlighting that investors with a $500,000 or $600,000 loan paying in the 7% region prior to the GFC, would be paying the same amount today on $1mil+ at 3-3.5% interest.

Interesting times.

Now the most important aspect, above all else will be property selection.

A Word of Caution

While a new cycle will bring new opportunities, not every opportunity will be investment grade, nor will every location.

It is also important to note that both inflation and wages growth will be low and very sluggish for the short to medium term.

You should be avoiding lower socio economic regions where wages just keep up with inflation and there is little wages growth.

This demographic tends to live pay check to pay check with lower rates of saving.

They also tend to settle and buy property more on what they can afford over where they would like to live.

Where the Opportunities Are

You should be looking for the opposite and thinking like an owner occupier rather than an investor.

They tend to think fairly logically and straight forward;

- Employment

- Infrastructure

- Schools

- Lifestyle

Firstly, with a long term focus, I would be looking to understand where the majority of jobs are being created.

This will create the highest demand for property, from people with higher disposable incomes.

These people tend to have high rates of savings, multiple income streams and superior wages growth.

They also tend to get emotional and pay too much for property and tend to overcapitalise on renovations and re builds.

Areas with easy access to employment with infrastructure and public transport will also increase in demand.

Once employment and the family are looked after, with good schools the focus, next on the checklist is lifestyle.

So target lifestyle precincts with high walkability.

Don’t’ Rely on the Market to do the Heavy Lifting

While no one can guarantee what will happen to property prices.

I like to have an insurance policy to ensure that my portfolio is not at the whim of the market, this is especially important in a low inflation environment.

Therefore, all assets I purchase, have the ability to add value somehow.

It may be a quick, cosmetic renovation or something more structural like adding an additional bedroom or bathroom.

A lot of savvy investors here in Brisbane are land banking development sites to which they can take advantage of the market and then add further value by developing at a later date.

Conclusion

We are close to the bottom of another property cycle in Australia with markets having not fallen as much as they have since the early 1990’s.

Storm clouds have disappeared as we have moved on from the Election, Interest Rates will remain low and APRA have loosened credit slightly.

Both lack of Economic growth and jobs Growth are still a concern.

So don’t leave it to chance, stick to locations with good jobs growth and superior wages and then buy the right kind of asset within that location.

This is where the team at Metropole can help you with their independent advice and research and in depth, on the ground market knowledge.

If you're looking at buying your next home or investment property here's 3 ways we can help you:

Sure our property markets are improving, but correct property selection is even more important than ever, as only selected sectors of the market are likely to outperform.

Why not get the independent team of property strategists and buyers' agents at Metropole to help level the playing field for you? We help our clients grow, protect and pass on their wealth through a range of services including:

- Strategic property advice. - Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

- Buyer's agency - As Australia's most trusted buyers’ agents we've been involved in over $3Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective - that's something money just can't buy. We'll help you find your next home or an investment grade property. Click here to learn how we can help you.

- Wealth Advisory - We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.