We’re into the last quarter of the year now, and what a year it’s been.

For many, it’s a year we’d rather forget, even though very few of us ever will.

So much has happened and so much has changed in our lives – well in some cases not much has really happened, as we’ve been stuck at home.

However, for homeowners and property investors it will be a year when the value of their properties will possibly increase by 20% – in some cases, they will earn more from property capital growth than they will from their day job.

Is it all going to come to an end soon, or are the forecast macro-prudential changes from APRA going to create a mini-boom over the next few months?

Last week the Council of Financial Regulators, the club of four main financial watchdogs, showed concern about the increased level of home lending in the first half of the year.

In particular, they signalled their concern about the number of mortgages taken out at more than six times the borrower’s income.

In last week’s Property Insider chat Dr. Andrew Wilson gave his views on why there is no case at present for interference in our housing market.

If you haven’t watched that conversation, check it out at www.PropertyInsiders.info which will take you to our YouTube channel.

Thousands and thousands of viewers watched that particular discussion.

But with the world of property moving so quickly and so much happening over the last week, I want to discuss possible outcomes of these proposed macro-prudential controls.

Will they slow the market, who will they hurt, or will they actually create a mini-boom?

There’s lots of other property news to discuss this week so I look forward to my chat with Australia’s leading housing Economist, Dr. Andrew Wilson chief economist of My Housing Market in this week’s Property Insiders chat.

What should we do about the housing boom?

Watch this week’s Property Insider video as Dr. Andrew Wilson and I discuss the issue of housing affordability.

In our chat last week, we explained how even though property prices have increased by around 20% this year, property prices have been flat overall since the previous peak in 2017, so the market is playing catch meaning over this property cycle average capital growth hasn’t been exceptional.

And noted that clearly, the market is working its way through the cycle with lack of affordability naturally slowing capital growth over the last few months.

But the media is asking who is going to fix Australia’s housing affordability issue.

The Reserve Bank won’t get involved as it has its operating instructions set on full employment and price stability, even though it recognises that ultra-cheap money is the accelerant of this property cycle.

RBA governor Philip Lowe says “While it is true that higher interest rates would, all else equal, see lower housing prices, they would also mean fewer jobs and lower wages growth. This is a poor trade-off in the current circumstances.”

The Council of Financial Regulators is concerned that just under 22 per cent of new mortgages in the June quarter were at debt-to-income ratios above six.

A year earlier it was 16 per cent.

The council has asked APRA to put together a list of potential measures.

But they’re going to have to be very measured in their response so as not to create unintended consequences such as a severe property downturn.

Watch out for unintended consequences of macroprudential controls

While tougher lending standards will certainly take some heat out of Australia’s property markets by restricting the number of people that can get home loans, or lessen the amount they can borrow, the move could backfire in the short term as investors in particular but also homebuyers try to rush and buy to beat the buzzer on the upcoming tightening of lending conditions.

Watch this week’s Property Insiders video as we discuss…

- Will the warning of impending macroprudential controls create a mini-boom with all those home buyers and investors who’ve already got finance preapprovals (and we know there’s lots of them) feeling an even more urgent sense of FOMO – before the changes are brought in?

- Will this mini-boom be accentuated by bringing forward demand from investors and homebuyers to get finance under the “old rules”?

- Targeting debt-to-income ratios will have a limited impact on higher-wealth households, who often have multiple streams of income. However, it will affect lower-income households and those purchasing property for the first time.

Here’s why debt to income ratios have risen

Firstly, low interest rates by their nature allow people to service more debt as repayments fall.

And second, the share of lending to first-home buyers has increased significantly on the back of HomeBuilder, the federal government’s First Home Loan Deposit Scheme, and individual state government incentives.

First-home buyers tend to be more indebted as they stretch to get into the market.

Given improving homeownership rates is the goal of these government schemes, it seems counterproductive to limit first-home buyers by reducing their ability to borrow.

And another reason that debt to income ratios have increased is that many established homeowners have upgraded their homes over the last year or two, partly because of the low-cost borrowing, partly because the value of the home has increased considerably given them equity to upgrade and also because of the increased requirements for more space such as a zoom room, etc.

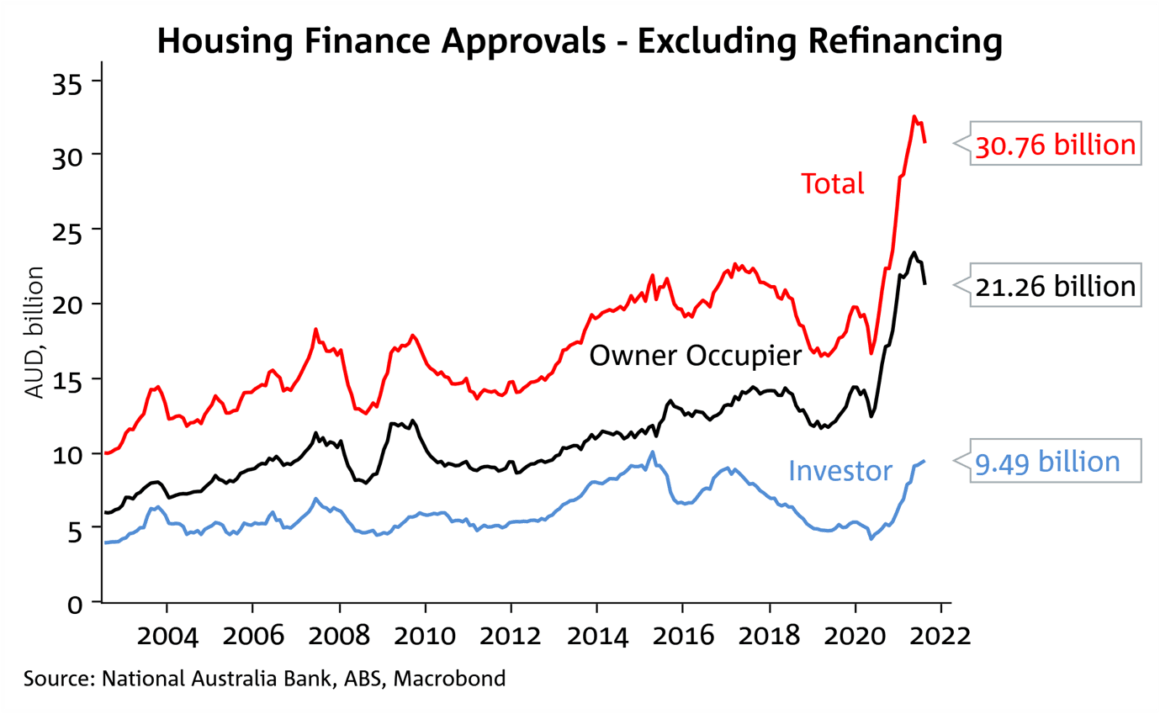

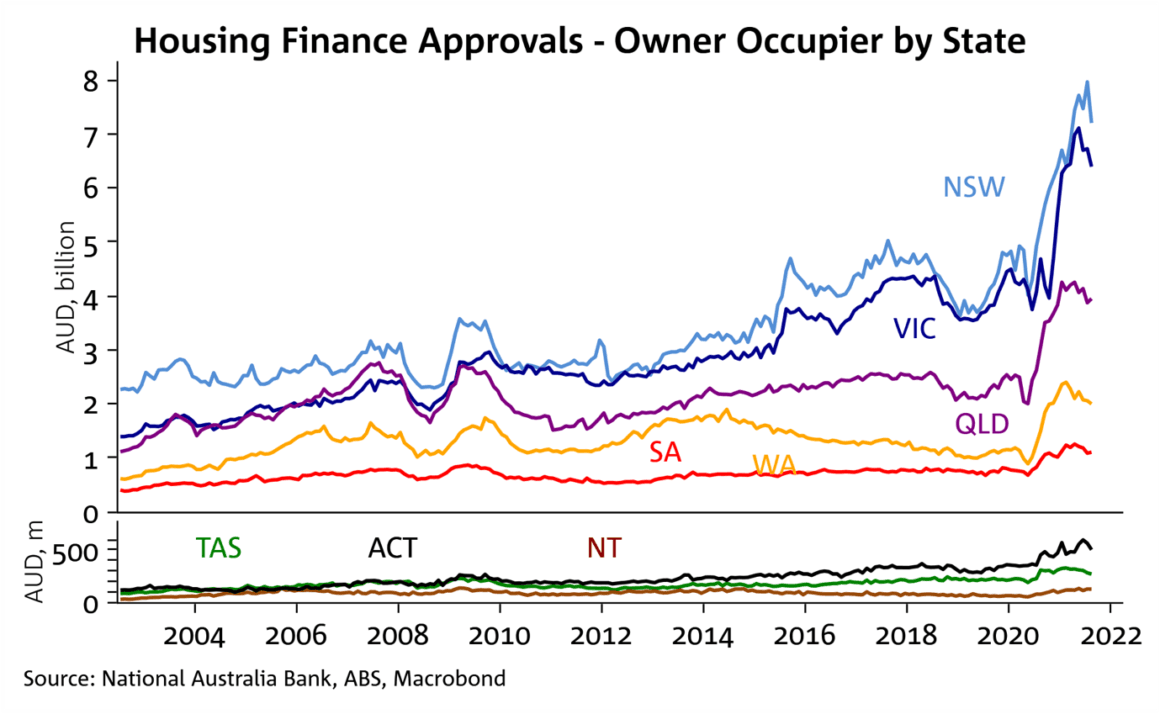

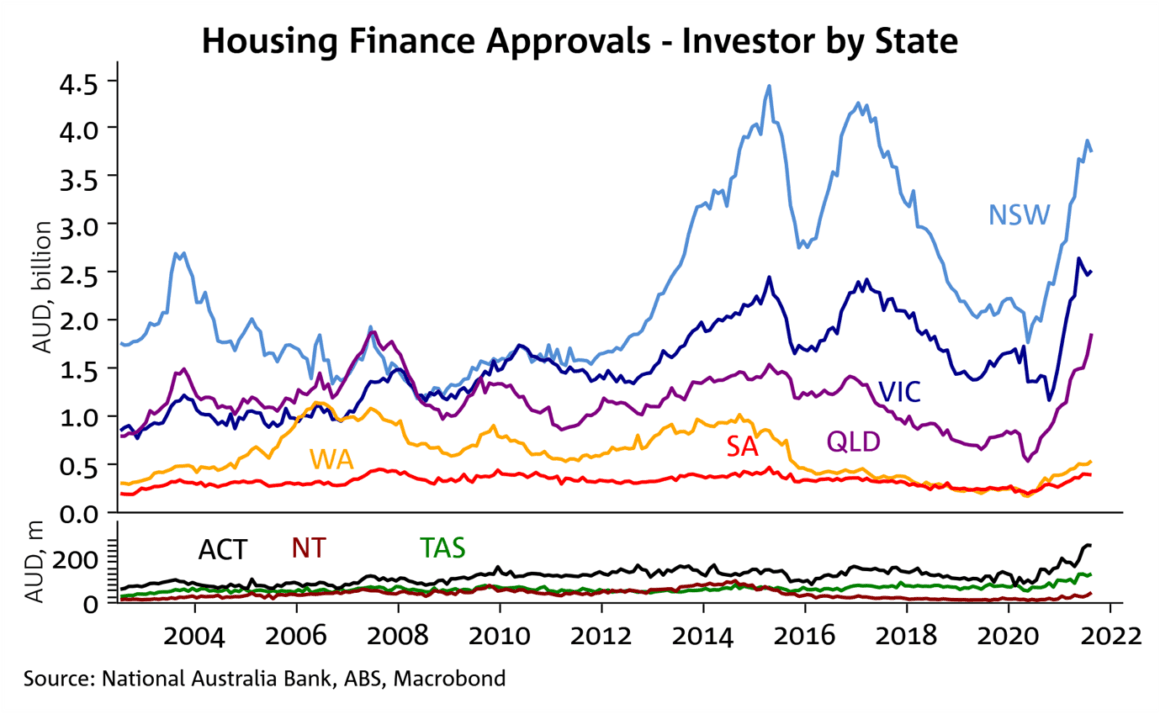

Housing loan approvals fall as lockdown bites

New housing loan approvals fell 4.3% month on month in August.

The decline was driven by a 6.6% fall in owner-occupier loan approvals, which more than offset a 1.5% rise in investor approvals.

It is clear lockdowns restrictions were behind the sharp falls in owner-occupier approvals seen in NSW (-9.6%), Victoria (-4.9% m/m), and the ACT (-11.0%), while smaller falls were seen in non-lockdown areas and even rose in Queensland (+2.0%) and South Australia (+1.8%).

As lockdown restrictions ease from October, it is likely housing market activity will turn back up again and it is worth noting housing loan approvals are still up 47.4% year on year.

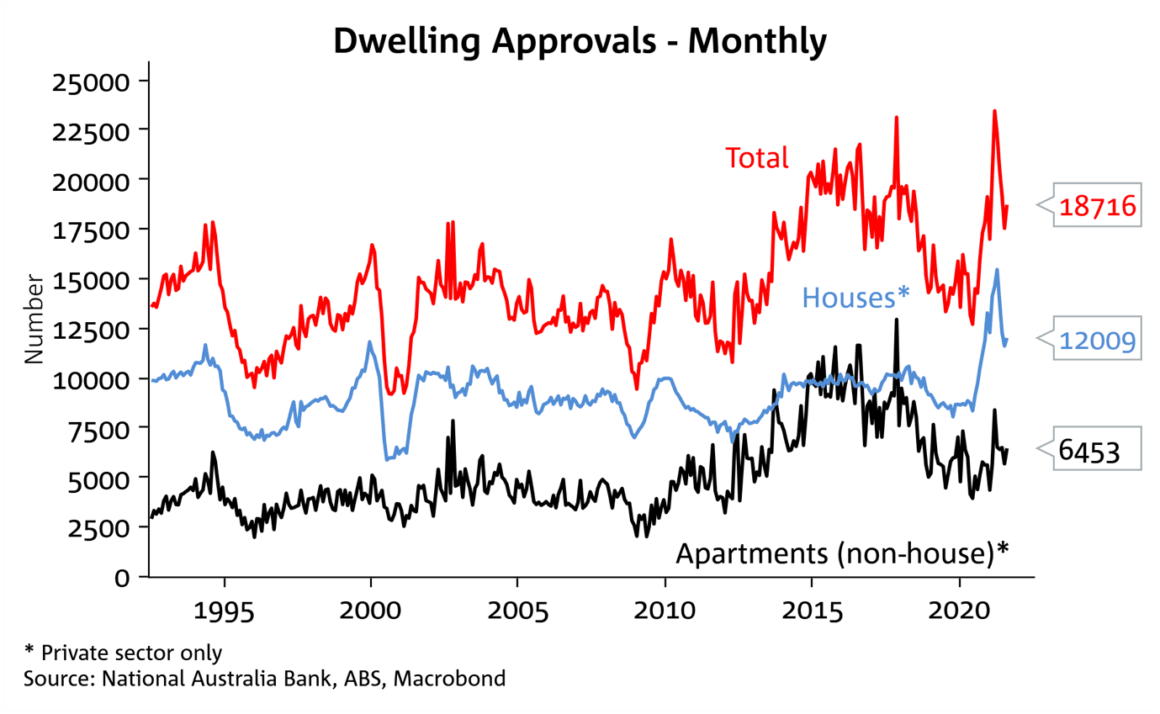

Building approvals rise in August despite lockdowns

Dwelling approvals recorded a big upside surprise in August, rising 6.8% against widespread expectations of a significant decline.

Watch this week’s property inside the video is Dr. Andrew Wilson and I discussed the impending shortage of apartments moving forward, this will be particularly evident when our international borders reopen

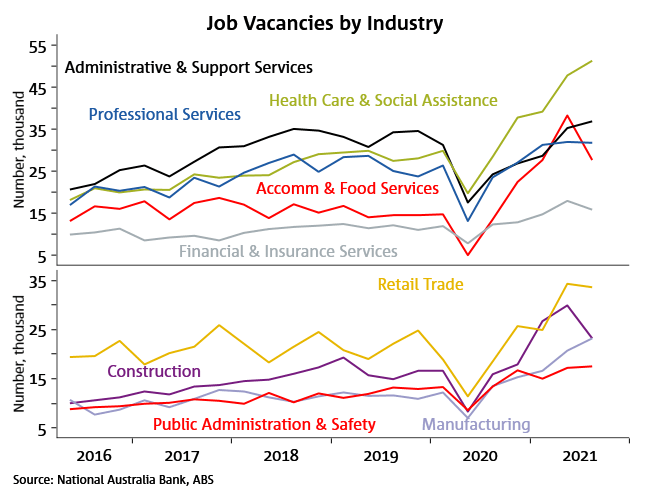

Job vacancies fall 9.8% on lockdowns, but remain well above pre-pandemic levels and support expectations for a strong recovery

Job vacancies fell a seasonally adjusted 9.8% in the three months to August, but importantly remain 46% above pre-pandemic February 2020 levels.

The decline was led by NSW and VIC which were in lockdown, but importantly vacancies actually rose in WA which has been less impacted by lockdowns and suggests strong labour demand remains in non-lockdown areas.

Overall the decline due to the recent lockdowns is relatively mild when compared to the 43.3% drop back in Q2 2020, signifying labour demand remains resilient and supports expectations for a strong recovery once lockdown restrictions ease.

.png)

This week’s auction results – another weekend of strong auction results

The first month of the spring weekend auction market is concluded with more remarkable results despite the burden of ongoing Covid restrictions in most capital cities.

Watch this week’s Property Insider video as we discuss how most Capitals continue to record generally strong results for sellers.

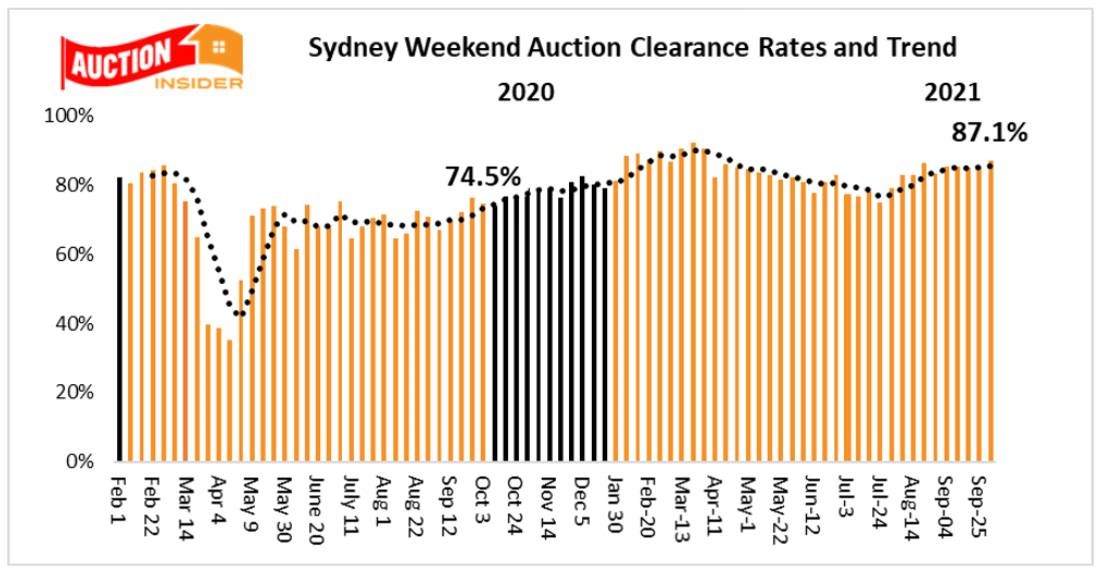

Sydney Auction Market

Another extraordinary result for the Sydney auction market

Sydney’s unstoppable weekend auction market has recorded another extraordinary result with clearance rates rising despite the distractions of the long weekend holiday and a sharp decline in listings.

Sydney recorded an auction clearance rate of 87.1%; up from last weekend’s 85.2% and well ahead of the 74.5% recorded over the same weekend last year.

Sydney has now recorded 9 consecutive weekends with clearance rates above 80%: and 5 straight weekends above 85%.

These boom-time level results will ensure property values keep rising throughout the balance of the year

The following chart from Dr. Andrew Wilson shows the Sydney auction clearance trend:

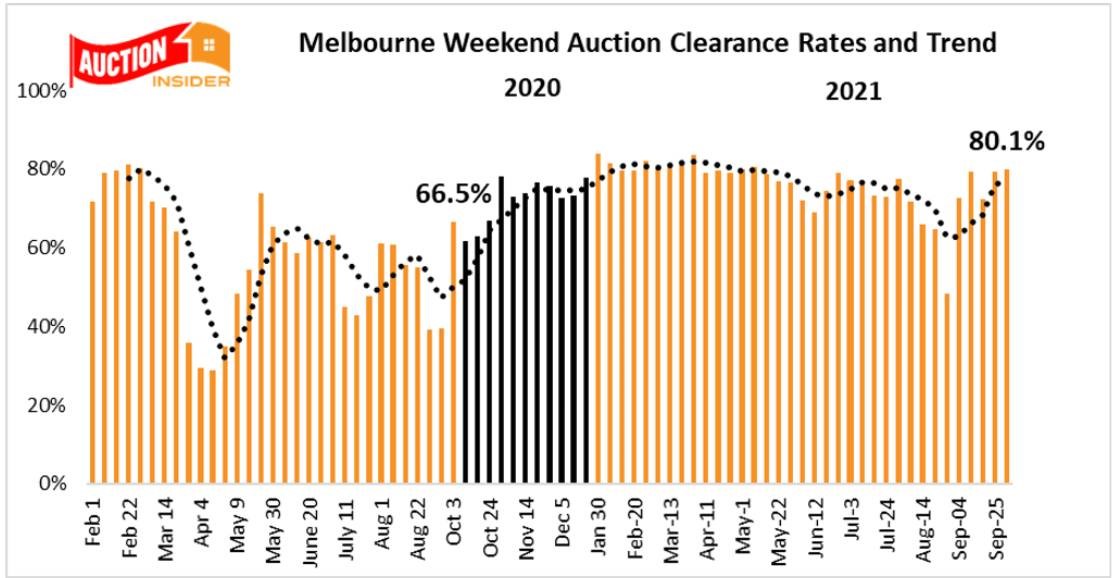

Melbourne Auction Market

Back to the boom for Melbourne’s auction market.

Melbourne’s weekend auction market has reported its first clearly boomtime result since May, despite a huge surge in listings driven by the easing of Covid property inspection restrictions.

Melbourne recorded a clearance rate of 80.1% on Saturday which was higher than the previous weekend’s 79.3%, and the 66.5% recorded over the same weekend last year when the local market continued to be severely impacted by the lockdown.

This week’s high clearance rate again reflected a significantly low proportion of withdrawals at 12.5% of reported actions compare to the previous weekend’s 20.8%.

Auction listings increased sharply at the weekend, with 571 auctions compared to previous weekends 269 and well ahead of 54 auctions over the same weekend last year.

The following chart from Dr. Andrew Wilson shows the Melbourne auction clearance trend:

..........................................................

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog, and hosts the popular Michael Yardney Podcast.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog, and hosts the popular Michael Yardney Podcast.

To read more articles by Michael Yardney, click here