Expert Advice with Simon Buckingham

The Federal Government's new first home mortgage scheme is scheduled to kick-off in January 2020 - and full details about how the new scheme will work have finally been revealed.

So it's timely to take a closer look and see how the introduction of this new scheme might impact property prices …

What is the new first home mortgage scheme?

The Government's "First Home Buyer Deposit Loan Scheme", as it's officially known, aims to reduce the minimum deposit required for a first home to just 5% of the purchase price.

Currently, most first home buyers would be required to save a deposit of 10% - 20% of the purchase price. There's little doubt that saving the required deposit is one of the biggest hurdles to home ownership.

Ordinarily, if you were borrowing more than 80% of a property's value, you would need to pay an additional fee called "Lenders Mortgage Insurance" (LMI) - which can run into the thousands, even tens of thousands of dollars.

For instance, if you were to borrow 95% of the purchase price on a $600,000 property, the typical LMI cost could be over $25,000 (which you'd need to save on top of your deposit).

Government Guaranteed 95% Lending

Under the "First Home Buyer Deposit Loan Scheme" however, the government proposes to support a reduced minimum 5% deposit for first home buyers by essentially "guaranteeing" the difference between a standard 80% LVR loan and a 95% LVR loan.

This government "guarantee" effectively eliminates any LMI costs that would otherwise apply to a qualifying first home buyer who wants to borrow 95% of the property's price - saving the buyer potentially tens of thousands.

Who qualifies...

The scheme will be available from January 1st 2020 to first home buyers earning less than $125,000 as a single, or under $200,000 as a couple.

The scheme can also be used in conjunction with other first home buyer incentives, such as State-based grants and stamp duty concessions.

For instance - with the first home buyer stamp duty concessions in NSW or Victoria, a first home buyer in either of those States could potentially have no stamp duty and no LMI to pay - meaning that the ONLY money they may need to buy their first home under the new scheme would be the 5% deposit (plus a little extra for the conveyancing costs, bank application fees, etc).

It's worth noting that usual loan servicing criteria will apply, so qualifying first home buyers will still have to demonstrate their ability to meet the repayment obligations of the loan under normal bank application processes.

Which properties qualify...

According to the government, the new scheme is intended to apply only to "entry-level" properties.

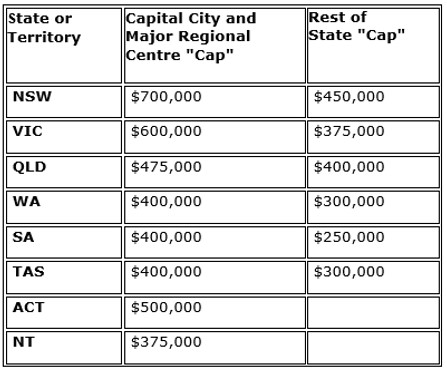

Exactly what qualifies as an "entry-level" property will vary by location...

Different "caps" on the maximum qualifying purchase price will apply between capital cities, major regional centres and the rest of each State as follows:

Which bank...?

According to Housing Minister Michael Sukkar, half of the loan guarantees will be provided through smaller lenders, while only two of the "big 4" banks will be chosen to take part in the scheme.

At the time of writing the two selected big banks hadn’t yet been announced.

It's "First-in, Best-dressed"!

Importantly, it has been announced that the "First Home Buyer Deposit Loan Scheme" will only support up to 10,000 first home buyers per year.

There were actually around 110,000 first home buyers in 2018, so capping the scheme to only 10,000 applicants per year represents less than 10% of the annual first home buyer pool.

The Government has determined that his "lucky" 10,000 will be selected on a first-in, best-dressed basis. In other words, the 10,000 deposit loan places will go to the first 10,000 qualifying first home buyers who apply each year.

Based on last year's volume of 110,000 first home buyers, it's possible that all the deposit loan places could be taken up within the first quarter of 2020!

Property Market Impact

Limiting the new scheme to only 10,000 first home buyers per year represents the greatest difference between this scheme and past First Home Owner Grant schemes.

Unlike the original First Home Owner Grant, which boosted the purchasing power of every first home buyer, this "First Home Buyer Deposit Loan Scheme" will only make a difference to around 10% of first home buyers each year.

While this will certainly increase the number of potential buyers in the property market (as it means 10% more first home buyers may be able to enter the market than otherwise could), a potential influx of 10,000 additional buyers doesn't quite represent the same kind of "boom trigger" that the original First Home Owner Grant did.

But some suburbs are ALREADY booming…

That said, it hasn't taken a new First Home Buyer Scheme to bring the property market back to life.

Sydney and Melbourne markets have witnessed a record-speed housing price recovery since mid-2019, and are on track for potential double-digit growth by mid-2020.

Brisbane, Adelaide, Hobart and Canberra have also seen growth over the last quarter.

Even Darwin and Perth, which have experienced negative growth for an extended period, are showing signs of stabilising prices - and may return to growth over the coming months.

Overall growth figures however disguise the mixed-bag under the surface...

CAREFUL SUBURB SELECTION IS ESSENTIAL!

While many suburbs are currently experiencing rapid price growth, many others are still flat or even in decline.

And then there are those suburbs poised for imminent price growth, where sophisticated property investors can position themselves now to take advantage of good buying opportunities - before the market really heats up!

(The ability to find suburbs with imminent price growth potential is an extremely valuable skill for an investor. You can learn how to do this yourself at our free in-depth property workshops.)

A new property boom on the cards?

While the new First Home Buyer Scheme on its own won't cause the market to boom, it does bring a potential 10,000 additional buyers into the market in early 2020 - far sooner than those buyers might otherwise have been able to enter.

This additional buyer activity could mean more action in the market than usual during the traditionally quieter January period... and only adds more fuel to the fire already set under property values on the Eastern seaboard.

Right now is therefore be a great time to be in the property market "cherry picking" opportunities...

For more property market insights and practical strategies, tips and techniques for investing successfully in the changing market, join me at one of our upcoming FREE in-depth property workshops.

...........................................................................

Simon Buckingham is Director of Results Mentoring and a highly experienced investor. Simon has been investing in property for over 15 years using a broad range of strategies including positive cash flow, renovations, property development and commercial properties, both within Australia and overseas.

Simon Buckingham is Director of Results Mentoring and a highly experienced investor. Simon has been investing in property for over 15 years using a broad range of strategies including positive cash flow, renovations, property development and commercial properties, both within Australia and overseas.

Holding university degrees in Commerce and Law, and with over 10 years' experience as a business consultant, Simon turned his back on corporate life forever following the births of his two children and now spends his time investing, developing property, supporting multiple charities, and building businesses - while teaching others how they can do the same. He has personally coached hundreds of investors in techniques that can be used to profit from property in any market conditions, regularly facilitates public workshops and provides other free resources for property investors through ResultsMentoring.com, and has presented to thousands of people at property conferences and seminars around Australia and New Zealand.

Simon writes the highly regarded Sophisticated Property Investor e-newsletter and his opinions on the property market and real-world investing strategies have featured in Your Investment Property magazine, Smart Property Investment, Channel7 News at 6, Kevin Turner's Real Estate Talk, and Property Observer. He is co-author of the critically acclaimed property book The Real Deal: Property Invest Your Way to Financial Freedom, and a founding Mentor in Australia's award-winning personal mentoring service for property investors: the RESULTS Mentoring Program.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.