And while Sydney’s high-priced market and bumper prices tend to dominate the discussion, there is one other capital city that has proven to be unstoppable.

Famous for its climate, lifestyle and more affordable property market, Brisbane’s unstoppable property market has emerged as a leader in price recovery.

Unlike the post-pandemic property downturns seen in markets elsewhere, Brisbane’s price downturn was “short and sharp”, according to the Domain’s September housing report.

Following a pandemic population surge and an increase in values of more than 43%, Brisbane’s property prices hit a record high in mid-June 2022, soon after the Reserve Bank of Australia (RBA) commenced its rate-tightening cycle.

Since slumping in December 2022, house prices have already recouped $39,000 of the $47,000 value lost.

Brisbane’s median house price rose 1.4% to $848,752 in the September quarter, meaning they’re now just 1% (or $8,000) below the peak, Domain’s report showed.

And data reveals both house and unit prices are on track to reach a record high before the end of 2023.

In fact, if prices continue to grow at the same pace as they did over the September quarter, home prices in Brisbane would be set to end the year up 8.0%, which would be close to double the average annual growth since 2010.

The record highs are also being felt outside the city - property prices in the Gold Coast and across many areas of regional Queensland are also sitting at record highs.

Brisbane’s unit market is steaming ahead

It’s not just the housing market outperforming either, Brisbane’s unit market is also unstoppable, having performed strongly for 6 consecutive quarters in a row.

The median unit price climbed 1.7% over the three months to September and 7.8% over the year to reach a record $495,143 – making the city one of only two capitals to achieve a unit price record over the quarter.

Brisbane’s unit prices have already sailed past the $500,000 median mark, to $539,169 as of early November.

This is what’s driving the market recovery

Affordability and tight supply are leading market recovery in Brisbane and regional Queensland, with more price climbs for the foreseeable future.

The city’s house and unit medians are still considerably more affordable than in Sydney ($1.5 million median) and Melbourne ($1 million median).

Nicola Powell, chief of research & economics at Domain pointed out that the tight rental market and undersupply were applying pressure to property prices, with the city’s stock levels sitting 45% below its 5-year average.

“That is massive and that will push up pricing … but there are tailwinds influencing south-east Queensland overall and it’s that liveability factor and greater affordability in comparison to southern cities,” she said, adding the Olympic Games deadline in 2032 gives Queensland a chance to deliver all the infrastructure it needs.

“If done right, south-east Queensland could become the best-connected city in Australia if we look at the Sunshine Coast, Brisbane, the Gold Coast as one designated chunk of land.”

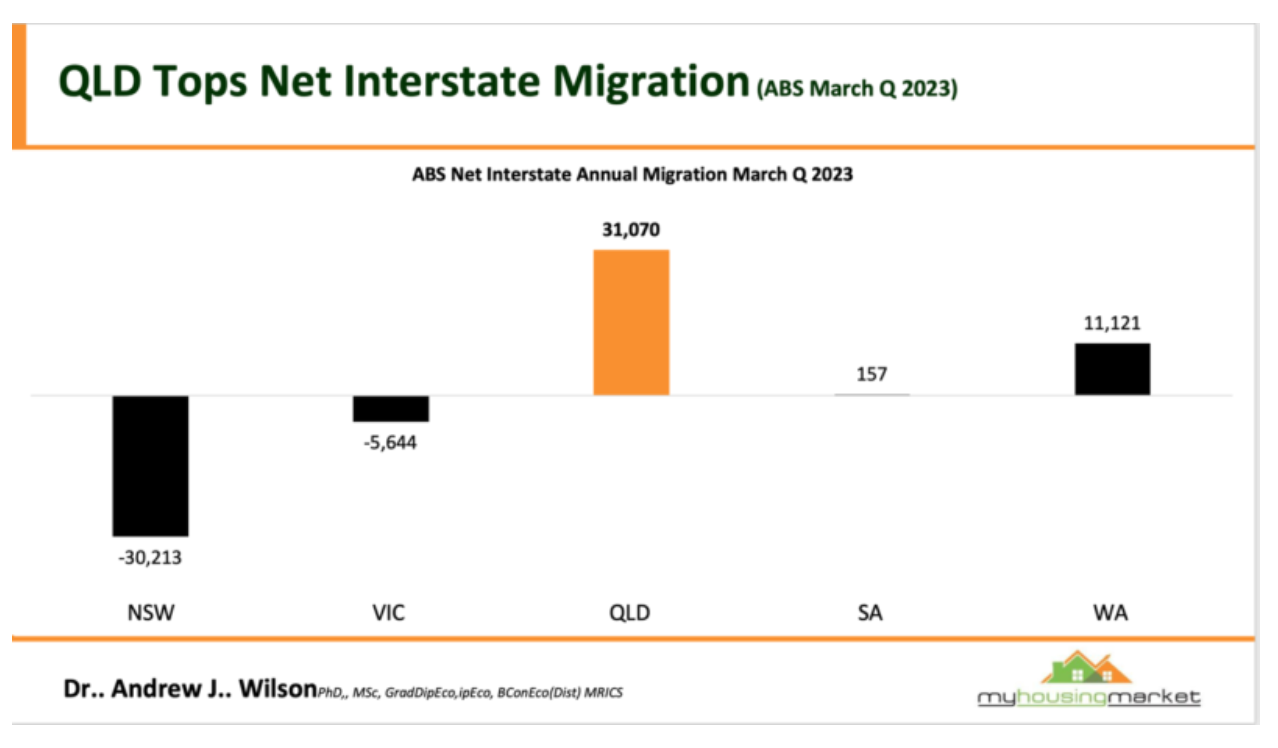

Internal migration also continues to be a significant driver for the city, with Australia still relocating in large volumes.

The recent spike in interstate migration to South-East Queensland combined with international migration will continue to create a perfect storm.

Federal government forecasts in January 2023 suggest that Queensland’s population is expected to grow by more than 16% by the time Brisbane hosts the Olympic Games in 2032, with the majority moving to the capital city itself.

A final note for investors…

Brisbane's property market is ripe for investment – its economy is improving, the population is growing, infrastructure is being added and property remains affordable.

But a word of warning… the Brisbane market is fragmented with some areas performing much more strongly than others.

So don’t invest in population growth areas -you know those new estates where there is no shortage of supply and most of the residents are young families many living week to week as the cost of living bites into their budget.

Instead, look for Aspirational locations where affluent millennials aspire to live as they move to the family formation stage of their lives.

These are the upper-middle-class areas and gentrifying locations of Brisbane which would also be considered A-grade suburbs.

When this wealthier demographic moves into a suburb they tend to push up property values and create a ripple effect producing economic, social, and cultural change.

Sure, your biggest challenge will be to find the right property to buy, but that’s what our team of Brisbane buyer's agents specialise in.

Even before looking for the right location, make sure you have a Strategic Property Plan to steer you through the upcoming challenging times our property markets will encounter.

Aside from remembering that you should focus your efforts on investment-grade properties and locations, you also need to remember that property investing is a process, not an event.

That means that things have to be done in the right order – and selecting the location and the right property in that location comes right at the end of the process.

And that’s because what makes a great investment property for me, is not likely to be the same as what would suit your investment needs.