Positive demand drivers managed to lift home prices in March, continuing the surprise uptrend in February.

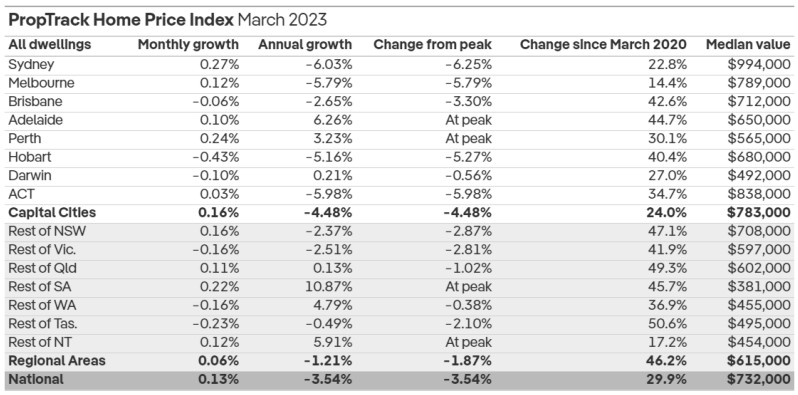

PropTrack Home Price Index showed a 0.13% increase across Australia in March.

Over the month, home prices increased 0.16% in capital cities and 0.06% in regional area0s.

Most capital cities and regional areas posted gains over the month, with Sydney and Perth leading the gains.

On an annual basis, however, home prices in the country are still down 3.54%.

Capital cities reported a steeper annual decline in home prices at 4.48% versus the 1.21% drop in regional areas.

PropTrack senior economist Eleanor Creagh said the softness in new listing volumes and tight supply has offset the weaker-than-peak-levels buyer demand.

“This led to a pickup in competition among potential buyers that has buoyed values,” she said.

Furthermore, while large price falls could result from the significant reduction in borrowing capacities and the deterioration in affordability due to rate hikes, the impacts were offset by growth drivers.

“Positive demand drivers offsetting the downwards pressure include the strong rebound in immigration, tight rental markets and slowly increasing wages growth,” Ms Creagh said.

“The sustained softness in new listing volumes is also keeping a floor under prices.”

If the Reserve Bank of Australia decides to pause, it could trigger the bottoming phase, with home prices stabilising further.

“Some of the uncertainty buyers have experienced with respect to borrowing capacities and mortgage servicing costs will also ease and may boost confidence,” Ms Creagh said.

“However, headwinds remain, with the full impact of recent rate rises yet to be felt. This means the decline in prices could still find a second wind, particularly if new listing volumes increase in the coming months.”

-

Photo by Tourism Australia on Canva.