Landlord insurance is offered by a variety of different types of insurance providers, who aren’t all created equal. There are specialist insurance companies that offer tailored policies for landlords, and there are banks and general insurance providers that offer add-ons and combined packages.

Unfortunately, they’re not all spruiking the same product, even if they claim to be. Let’s look at the difference between specialist providers and general insurance providers, starting with what you’re aiming to cover yourself against.

I have building insurance. Do I need landlord protection?

Absolutely!

Every investor needs to have landlord insurance in place. Building insurance only covers damage to the building as a result of any of the following events:

• storm

• flood

• water and oil leaks

• earthquake

• lightning

• fire

• theft or attempted theft

• vandalism or a malicious act

Landlord insurance is vital because it protects investors from tenant-related expenses, such as:

• loss of rent

• malicious and accidental damage

• theft by the tenant

• tire, storm and flood damage

• legal expenses

• public liability

There’s no question that landlord insurance is one of your best defences against potential financial stress. The next question is: which kind of provider can give you the strength of coverage that will protect you when you need it most?

Combined package vs tailored insurance

Opting for a combined package through a bank or big-name insurance company carries a certain amount of risk. The ease of having all your insurance through one broker – and the possibility of a slightly lower premium – might look appealing; however, Sharon Fox-Slater, executive general manager of EBM RentCover, says these policies don’t automatically cover all the important tenant-related risks.

• Will you cover fire deliberately set by the tenants?

• What are your excesses and is there a limit to the number of excesses to be paid for simultaneous claims?

• Can I use my bond to pay my excess?

• Does ‘accidental and malicious damage’ cover the building as well as the contents?

• Do you continue cover if my tenant is on a periodic or continued lease?

• Do you cover pet damage?

• What does ‘loss of rent’ cover?

“Their landlord policies are often a building and contents policy with some extras that you can add on, and you can’t count on them to explain to you that it’s not necessarily the right protection for a rental property,” she explains.

The scope of uninsured circumstances in these add-on policies is alarming, particularly as some of them are the most common causes of landlord claims.

A good example is ‘loss of rent’. It’s easy to assume that just because your combined policy states that it covers loss of rent, it does so in all circumstances, but this can be very misleading.

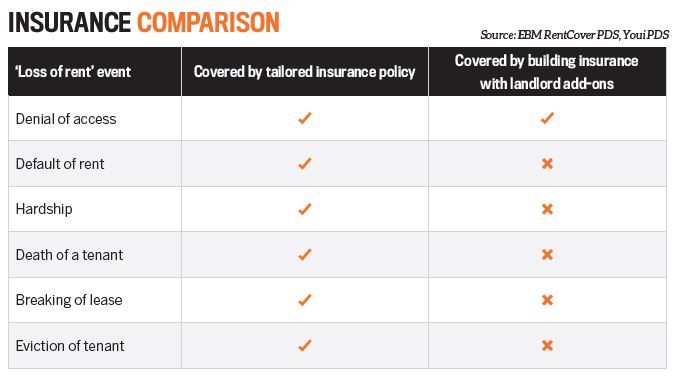

For example, a straightforward comparison between a tailored landlord policy and an off-the-shelf building insurance policy with an added landlord component quickly shows the difference – and the risk – to investors who find their properties vacant.

In this scenario, the combined package policy only covers the landlord for loss of rent when the property is untenantable due to damage. It doesn’t cover changes in the tenant’s financial circumstances, breaking of the lease, eviction, or death of the tenant. Some of them are available to choose as an extra add-on, as long as you read the fine print to find that out.

According to Fox-Slater, 86% of claims at EBM RentCover are for loss of rent, so it’s essential that you’re fully covered.

“For example, we recently had a claim where we paid out 12 months’ loss of rent to a policyholder because the tenant refused to leave and the courts were so busy it took months to get a court order,” she recalls.

“There are so many different circumstances that can stop your rental income, so look carefully at the specifics of your policy.”

On the other hand, specialist landlord insurance companies are more up front about the specifics of their coverage and excesses, and typically cover a wider spectrum of events and incidents that landlords are likely to ace.

“When you have a product that’s been specifically designed to cover tenant-related risks, you have the bulk of the inclusions that you need, and that’s going to give you peace of mind,” says Fox-Slater.

STRATA TITLES AND SHORT-STAY RENTALS

Owners of strata titles are covered by the strata building insurance policy. However, the public liability component only covers common ground. If someone hurts themselves inside your property, you’re liable to pay the damages. Landlord insurance comes with built-in public liability insurance, often covering up to $30m.

Many insurance policies won’t continue to provide cover for a property that’s left vacant for long periods of time, or will only cover a fixed lease rental. That means if your rental is short-stay accommodation, make sure you use a specialist insurance company who can tailor

a policy for you.

Download your free report now! At risk-report.rentcover.com

While due care is taken, the viewpoints in sponsored content do not necessarily reflect the opinions of Your Investment Property.