08/11/2012

Watch out! Any investor that purchases property in these urban areas is likely to see their property values tank on the back of lackluster demand and a steep oversupply of housing

.jpg)

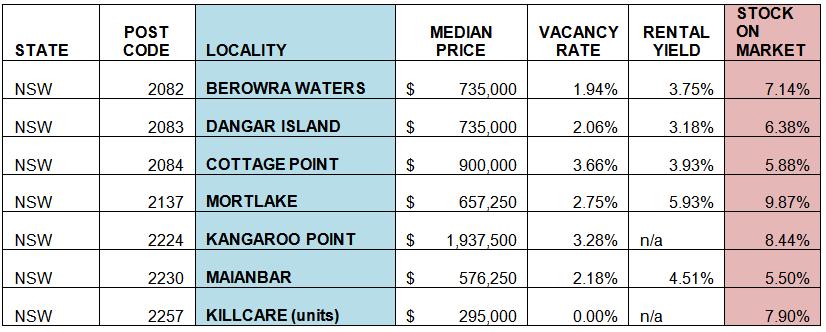

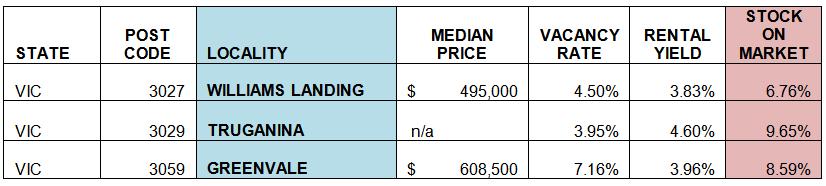

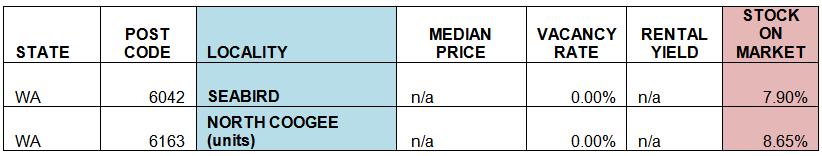

A market is widely considered to be in oversupply whenever the proportion of properties coming onto the market exceeds at least 4%.

This makes the case for investing in the following suburbs a tale of caution, as high proportions of stock on the market point to an environment where there will be little pressure on the buying market and prices are likely to fall.

In each of these markets, vacancy rates – the proportion of rental properties that remain untenanted – is also high. This indicates that property investors endure difficulties attracting tenants to their properties.

A high amount of vacancies is considered anything above 3%.

One additional factor is that rental yields are similarly disappointing.

GREATER SYDNEY

MELBOURNE

PERTH

Source: DSRscore.com.au

Brisbane data shows no markets where stock on market figures exceed 5.5%.