Jason Paetow is the managing director of AllianceCorp, a national property investment consultancy that educates everyday Australians on tailored investment property strategies so they can build successful property portfolios. Your Investment Property magazine asked him to explain the benefits of investing in property through a self-managed super fund.

"Without a doubt,the greatest advantage of purchasing

property through super is the leveraging capability"

YIP: Most people have their superannuation in a retail or industry fund, so why is investing in property via SMSFs emerging as such a popular alternative?

Jason Paetow: According to 2018 data from the Association of Superannuation Funds of Australia, a comfortable retirement for a single person requires a lump sum at retirement of approximately $545,000. But people are retiring without sufficient super in their accounts – $153,000 is the average balance for a male at retirement, and it’s completely inadequate to maintain a comfortable lifestyle for the next 10 to 20 years.

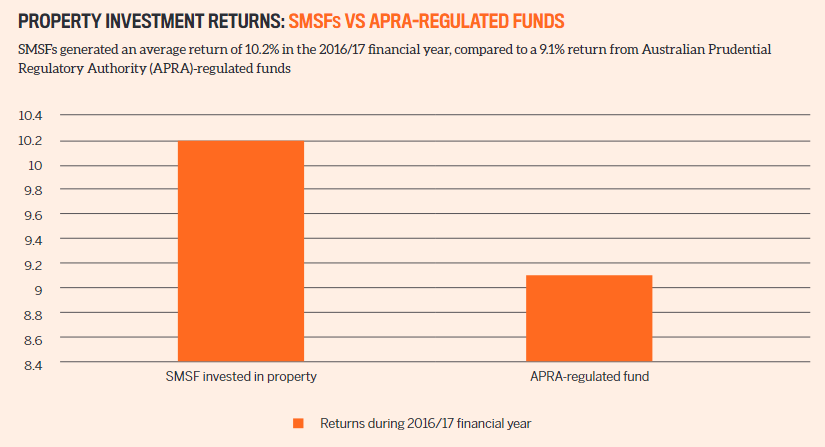

Property investment via SMSFs gives control back to consumers and potentially increases their retirement funds above and beyond the projections needed. They’re one of the fastest-growing retirement investment structures, and they’re now officially outperforming other types of superannuation funds.

YIP: How can investors benefit from using this sort of structure?

Without a doubt, though, the greatest advantage of purchasing property through super is the leveraging capability. When purchasing property through an SMSF, individuals can secure finance of up to 70% of the property value, provided they meet the lender criteria. This means they only need to invest a small amount of their funds in the property.

Additionally, where individuals can’t secure funds to leverage a purchase or don’t have enough to purchase outright, they can also consider a property trust where they can invest with others into direct property.

YIP: Are there any specific rules around investing this way?

JP: There are some rules around buying direct property through your SMSF. The property cannot be your principal place of residence. The purchase of land for the development of a house and land package, as well as traditional development – where you settle on the land first – are not allowed. In order to invest in this type of property through super, one would need to find a builder or developer who could sell the property on a one-part contract.

YIP: What are some of the risks for investors to keep in mind?

JP: There a few key risks – negative cash flow, lack of diversity in your portfolio, underperforming properties, and financing costs. As with any investment, fluctuations and their impact on after-tax cash flow all need to be considered.

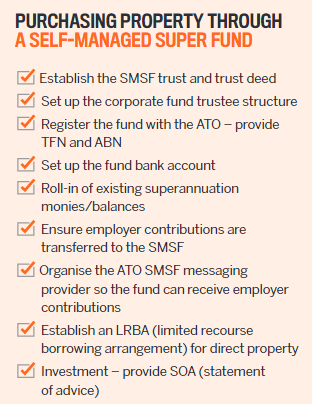

Additionally, not everyone has a background in finance and tax, so the administration of establishing an SMSF and the legalities of remaining compliant can be challenging.

YIP: Are there particular types of property that have proven to be more popular than others?

JP: Commercial property is currently the most popular property strategy as it generates very high yields. However, residential property is growing in popularity – not everyone has the capacity to invest in a commercial property. AllianceCorp is unique in the buyer’s advocacy space as the property consultancy assists with sourcing, evaluating and purchasing investment properties throughout Australia. While we’re not financial planners, we can refer you to SMSF specialists.While every investment carries risk, it’s hard to ignore the advantages of leveraging super through direct property investment.

CLAIM YOUR FREE GUIDE ON BUYING PROPERTY THROUGH SUPER

- Text 'SMSF' along with your name and email to: 0427 404 061 to recieve your free guide.

Disclaimer: AllianceCorp recommends that individuals seek professional advice before they consider implementing any strategies discussed in this article with a licensed financial advisor.