This potent cocktail is all but guaranteed to push house prices and rents higher in 2024 and beyond.

The looming shortage

The Australian property market is facing a significant challenge - a rapidly increasing housing shortage not just for 2024, but also for several years to come.

This situation, shaped by a combination of factors, is set to profoundly impact house prices and rental markets in the coming years.

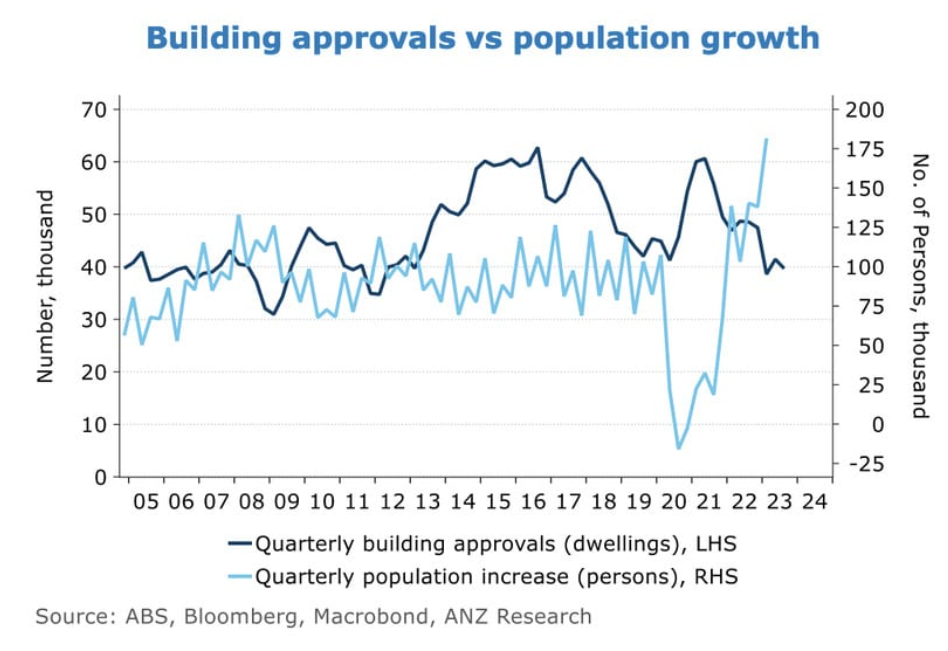

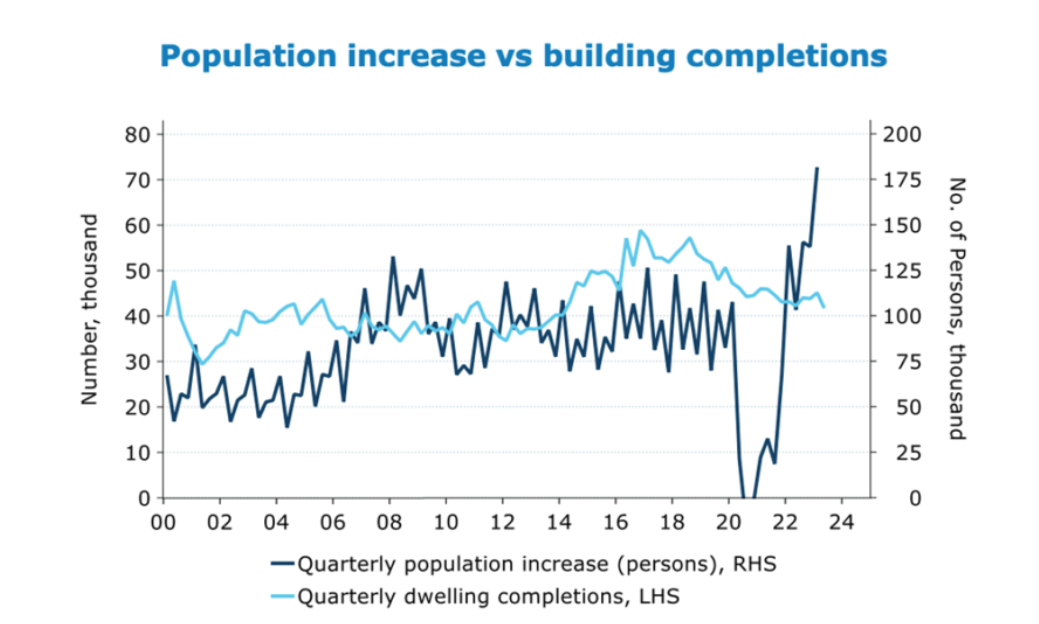

As you can see from the following chart, we’re just not building enough dwellings for our booming population.

In fact, Australia's housing market has been plagued by under-supply for years.

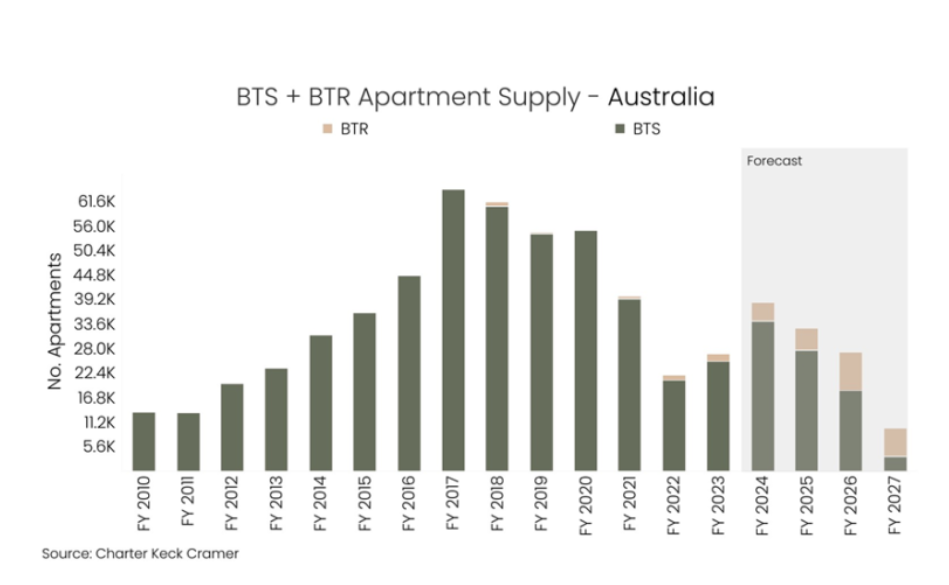

The only reason it's not worse right now is the high-rise apartment boom that ran from 2017 to 2020.

But the easy pickings are now gone and apartment construction is projected to plummet back to 2010 levels, leaving a massive gap in the housing pipeline.

The end of the high-rise boom

Remember the federal government announced plans to build 1.2 million new dwellings in the next 5 years, and construction of medium-density and high-rise apartments will be crucial to addressing the housing shortage because they offer a way to add significant housing units at scale.

However, currently, builders are facing numerous challenges:

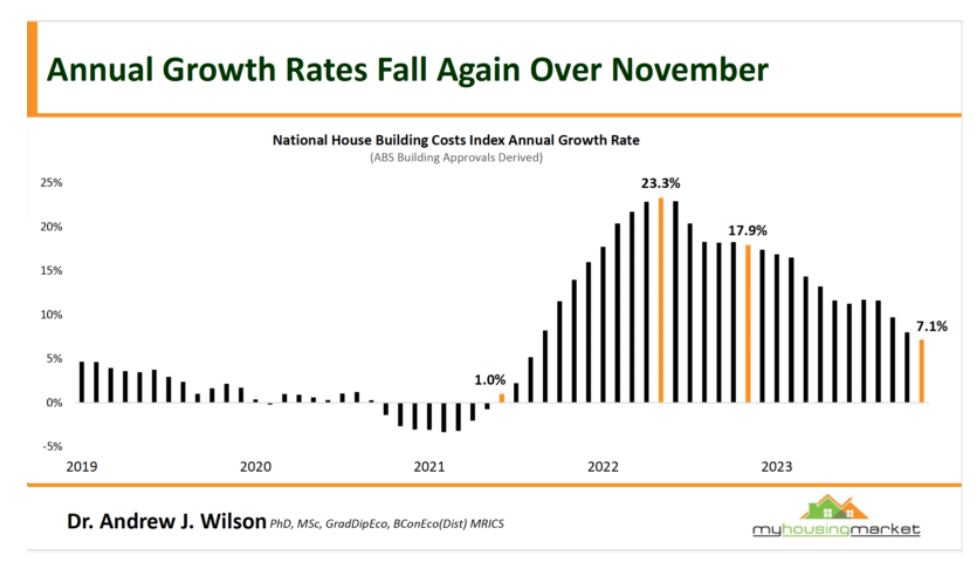

- Soaring Material Costs: Building materials skyrocketed in price, with some materials experiencing inflation rates of up to 18% per year. While costs have come down to 8%, they remain historically high, making large-scale projects risky and expensive.

- A construction Industry Crisis: Corporate insolvencies are rising across the country, with construction companies bearing the brunt of the pain. This points to a struggling industry ill-equipped to handle a massive building boom.

- Trade Shortage: A shortage of skilled tradespeople further cripples the construction industry, as large infrastructure projects compete for the limited workforce.

Dwelling approvals: a grim picture

These challenges are reflected in dwelling approvals, which have plummeted to record lows despite the surge in our population.

This stark disconnect paints a clear picture: housing supply is failing to keep pace with demand, and the gap is only widening.

Price growth inevitable: buckle up for 2024 and beyond

With the housing shortage expected to worsen in 2024 and beyond, the natural consequence is continued upward pressure on house prices and rental costs.

As supply remains constrained and demand continues to rise, affordability will become a growing concern for many Australians meaning our property markets will be fragmented as those with higher incomes or with equity in their existing homes are able to move or upgrade, while the “cheaper” end of the property market will suffer.

It also means that some home buyers will consider buying townhouses or apartments while others will move to adjoining more affordable suburbs.

What lies ahead?

The convergence of a decline in high-rise construction, industry challenges, and low dwelling approvals against a backdrop of population growth paints a clear picture: a deepening housing shortfall that will drive up property prices and rentals.

The government’s initiative of reducing future migration isn't really going to help the housing shortage, as the changes will affect international students and temporary visas rather than permanent migration numbers.

While the housing shortage is expected to continue in the foreseeable future, and will create challenges for some, property investors who take advantage of the current market situation will look back in a few years’ time wondering how they bought their properties so cheaply.