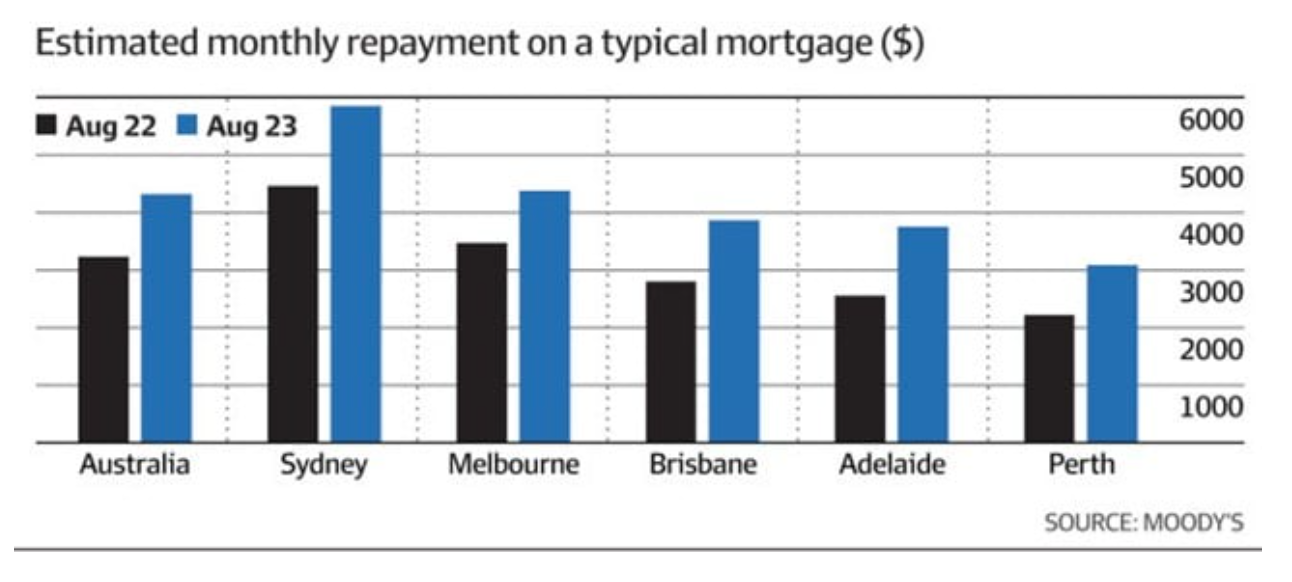

Mortgage repayments have surged since last May when the Reserve Bank began hiking interest rates from a rock bottom of 0.1% to the 4.1% kept on hold for October.

Many Aussies have suffered a mortgage repayment increase of around $1,000 per month while typical mortgage repayments have increased 34%, which combined with inflation and lower savings levels has seen households in some areas increasingly falling into arrears.

Source: Moody’s/AFR Weekend

Blacklisted: The suburbs hardest hit by mortgage arrears

Credit ratings agency Moody's Investors Service has revealed the 20 worst suburbs regarding borrowers being 30 days or more behind on their monthly mortgage repayments.

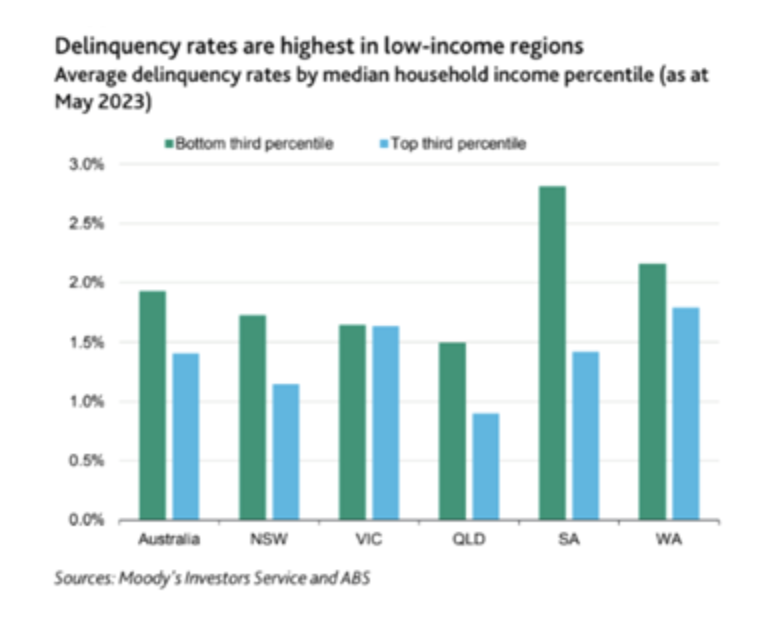

Moody's analysts Alena Chen and Philip Au noted mortgage delinquencies have risen in every state and territory of Australia, with lower-income areas, particularly in outer-suburban areas, bearing the brunt of interest rate hikes and inflation.

“We expect delinquency rates will continue to rise moderately through to the end of this year as high-interest rates and cost-of-living pressures further erode household savings,” they said.

Almost half (9 out of 20) of the ‘risky’ suburbs are in Melbourne, with one in nearby Geelong, five in Perth, one in Adelaide, two more in regional areas and surprisingly, only two in Sydney, Australia's most expensive property market.

No Queensland suburbs made the list.

Melbourne CBD comes in first place as the worst-affected area for mortgage arrears, with 4.87% of borrowers in arrears - around 3 times the national average.

Byford, in Perth's south-east, is in second place with 4.74% of borrowers falling behind on their mortgage.

Geelong, southwest of Melbourne, was third on the list with 4% of borrowers overdue in the suburb of Bellbrae.

In fact, the top 10 on the list are all located in Victoria (7 suburbs) and Western Australia (3 suburbs).

Sydney’s riskiest suburb, which comes in 15th place with 3.31% of borrowers in a delinquent situation, is Currans Hill in the city's outer south-west.

Adelaide's first appearance on the list is in 18th place with 3.21% of borrowers in Paralowie behind on their repayments.

And it’s not just city suburbs which lenders have blacklisted, some regional areas are also on the list.

Albany in south-west of Western Australia comes in 11th place, with 3.51% of borrowers in arrears.

And Belgravia, north-west of Orange in the New South Wales central west, was in 17th spot with 3.23% of borrowers behind in repayments.

Australia's 20 worst postcodes for mortgage arrears

- MELBOURNE, 3000

- BYFORD, 6122, Perth south-east

- BELLBRAE, 3228, Geelong

- BALGA, 6061, Perth north-west

- ALBANVALE, 3021, Melbourne west

- ELTHAM, 3095, Melbourne northeast

- CALDER PARK, 3037, Melbourne west

- ALEXANDER HEIGHTS, 6064, Perth north-west

- PAKENHAM, 3810, Melbourne south-east

- WOLLERT, 3750, Melbourne north-east

- ALBANY, 6330, Western Australia south-west

- EMBLETON, 6062, Perth north-east

- SOUTH WHARF, 3006, Melbourne inner

- GOSNELLS, 6110, Perth south-east

- CURRANS HILL, 2567, Sydney outer south-west

- CARDINA, 3978, Melbourne south-east

- BELGRAVIA, 2800, New South Wales central west

- PARALOWIE, 5108, Adelaide north

- FAIRFIELD, 2165, Sydney south-west

- ST KILDA, 3182, Melbourne inner

Interest rates, and savings levels put households ‘at risk’

It’s not just rising interest rates that have put these households at risk, the rising cost of living and dwindling household savings are also a cause for concern, particularly at a time when repayments have increased so much.

The analysis shows that household deposits dropped by $6 billion in the June quarter, according to the Australian Bureau of Statistics.

Meanwhile, the household savings ratio dived for the seventh straight quarter to 3.2 per cent, which is its lowest level since 2008.

Chen explains that inflation while easing from recent peaks, remains above the Reserve Bank’s target range, which means that borrowers have to contend with high consumer prices, and also that interest rates will likely remain at current, elevated levels for an extended period.

“The combination of high inflation and elevated mortgage repayment costs is eroding household savings, which will in turn result in more borrowers falling behind on loan repayments,” she said.

While mortgage arrears in Adelaide have jumped 0.5% to 1.7% since March last year, they have risen 1.06% to 2.66% across the rest of South Australia.

The trend is similar in the Northern Territory, where over the same time arrears jumped 1.49% to 3.21% outside of Darwin.

In the city, however, they rose from 0.39% to 2.99%.

Moving forward, markets will be fragmented

Moving forward our property market will be much more fragmented.

After all, there was never just one Sydney or Melbourne property market but markets within these markets – there are houses, apartments, townhouses, and villa units located in the outer suburbs, middle ring suburbs, inner suburbs, and the CBD.

And they're all behaving differently.

Why?

Because each different socio-economic and demographic segment across the city is experiencing the rising cost of living differently.

Inflation, higher rent, and higher mortgage costs at a time when wages aren’t rising at the same rate will either prevent first-home buyers from entering the market or restrict their borrowing capacity.

There are many first-home buyers who borrowed to their full capacity and will struggle to make repayments at increasing rates going forward which will restrict capital growth at the lower end of the property market.

Then there are the gentrifying suburbs where more affluent homeowners have established money with higher disposable incomes and who are at minimal or even no risk of defaulting on mortgage repayments even in the face of rising rates.

A final note for investors

At Metropole, we recommend investing in suburbs where residents’ income is increasing faster than the national average.

These are usually gentrifying areas or aspirational suburbs.

Residents in these locations typically have higher disposable incomes and are likely to be prepared to pay a premium to live in a property in one of these locations.

So it's these suburbs that are able to withstand fluctuations in the property market and increases in interest rates.

Rather than trying to hunt down a bargain, focus on buying an investment-grade property in an A-grade location because these types of properties are in short supply but are still selling for reasonably good prices… Plus they’ll hold property value over the long term.