Superannuation is a smart and simple way to save for retirement - the more you put into your superannuation, the more you have for retirement.

However, super is a long-term investment, starting from when you start your first job and only accessible once you reach retirement age.

Your employer contributes under the Superannuation Guarantee scheme an amount that is currently 10.5% of your wages and then you can also make extra contributions in order to boost your retirement savings further.

Additional contributions can also help reduce your tax.

In fact, when it comes to your super and tax, it can be difficult to determine what you can expect to pay.

After all, the amount you’re taxed on your super will depend on your age, the amount in your super, and how and when you withdraw it.

What’s more, the current government has proposed a plan to curtail tax concessions for rich Australians, which could make it even more confusing to work out how much your super will be taxed.

But understanding the rules around how your super is taxed is essential to help to understand how to make your money go further.

Generally, your super is taxed at three different stages: when it is added, on its earnings, and when it is removed.

Here’s a breakdown of everything you need to know about your super and tax.

Tax on your super contributions

The amount of tax you pay on your super contributions depends on the contribution type.

Generally, you can split these into two categories: pre-tax contributions, and post-tax contributions.

Pre-tax contributions (Concessional Contributions)

You can expect to pay a 15% concessional rate on any pre-tax contribution such as employer contributions or salary sacrifice.

This 15% tax rate is significantly less than most marginal tax rates which are designed to encourage earners to put more money into their super account to pay for retirement.

There is one exception though - if your income and super contributions combined exceed $250,000 then you would be subject to pay an extra 15% ‘division 293 tax’.

Also, you need to note that there is a concessional contributions cap of $27,500 applied to pre-tax contributions.

This amount includes any Superannuation Guarantee payments.

Any concessional pre-tax contributions exceeding this amount will be taxed at your marginal tax rate and may need to be withdrawn.

Post-tax contributions

Meanwhile, you can expect to pay no tax on any post-tax contributions, such as personal contributions made from your take-home pay, contributions paid into your super account by your spouse, or proceeds from an inheritance, or from the sale of an investment property.

This is because these contributions are made from take-home pay, which means tax has already been made.

Currently, the cap is $110,000 per year with some restrictions due to age or your superannuation balance.

You can also receive a tax rebate (back into your super account) if you earn under $37,000 per year through the government's low-income super tax offset scheme.

Tax on your super earnings

Once you have funds in your superannuation account, you’re also required to pay tax on any earnings made.

This includes things such as interest, dividends, and rental income during your accumulation phase (pre-retirement when you’re still adding to your super).

These investment earnings, including concessional contributions, in your superannuation account are only taxed at 15%, which is automatically deducted from your investment earnings by the fund.

The tax on capital gains is 10%.

The good news is that once you reach your retirement stage (65 years old or earlier if you meet another condition of release), you won’t have to pay any tax on your investment earnings, including capital gains.

Tax on your super withdrawals

This is when things get tricky.

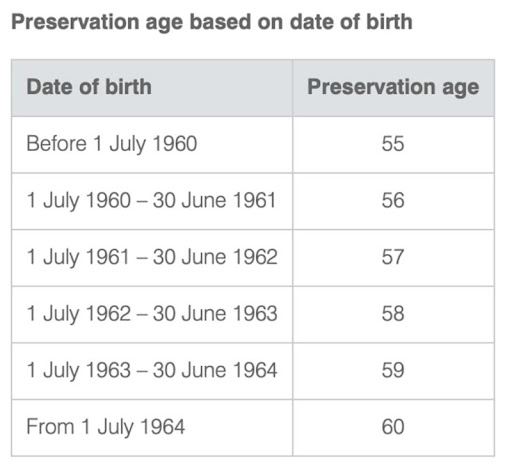

The amount of tax you are charged on withdrawals from your super account depends on whether you have reached retirement age (65 years old), preservation age (between 55 years and 60 years) depending on when you were born, your work status, and whether you’re withdrawing a lump sum or setting up a super income scheme.

Your preservation age is not the same as your pension age - your preservation age is the age at which you can access your super if you are retired (or have started a transition to a retirement income stream) whereas your retirement age is the age you can access your super regardless of whether you’re still working or not.

The table below will help to determine what your preservation age is.

You may also be able to access your super early under special circumstances such as financial hardship or compassionate grounds.

Tax on lump sum payments

First, let's start with the tax breakdowns for lump sum withdrawals from your super account:

- If you are under preservation age: 22% or your marginal rate (whichever is lower)

- If you are between preservation age and retirement age and you want to withdraw a lump sum UNDER $230,000: 0%

- If you are between preservation age and retirement age and you want to withdraw a lump sum OVER $230,000: 17%

- If you are over 65 years old: 0%

Tax on income stream payments

A super income stream is when you withdraw your money as small regular payments over a long period of time.

If you're retirement age (65 years) or over, this income is tax-free.

If you're under retirement age and are eligible to access your super early due to hardship or special conditions, your nominal tax rate will be applied to the taxable element of your super income stream payment.

There are also special rules under the transition to retirement after age 55.

Can I withdraw any of my super tax-free?

Yes, but only if you have met a condition of release.

If you made non-concessional voluntary contributions using your take-home pay, you’ve already paid tax on that sum of money.

That means you won’t be taxed again if you want to remove that money from your super.

Exceptions apply though, as do caps if you want to access this before it is eligible for release.

Tax on death benefit payments

When a person dies, in most cases their super provider pays their remaining super to their nominated beneficiary, otherwise known as a super death benefit.

The tax on a death benefit depends on the following:

- whether you were a spouse or tax dependant of the deceased

- whether it is paid as a lump sum or income stream

- whether the super is tax-free or taxable

- your age and the age of the deceased person when they died

If you are a dependent

As with other types of super withdrawals, if you're a spouse or tax-dependent (child under 18) you won’t be liable to pay tax on the tax-free components of the death benefit payment regardless of whether you withdraw it as a lump sum or through an income stream.

The income stream can only be allocated to spouses or tax dependents.

If you are not a dependent

If you're not a tax dependent of the deceased and you receive a death benefit as a lump sum, the taxable component of the payment will be taxed at 15% plus Medicare levy on any amounts not allocated as non-taxable, usually, the funds contributed from after-tax monies.

The bottom line

Super is a great way to save money for your retirement and is generally taxed at a lower rate than your regular income.

But exactly how your super is taxed, and the rate depends on various different factors - from your age, to whether the money in your super account was added pre- or post-tax and even how you withdraw it and when.

Please note that all the above comments are made as general advice which has not taken your specific circumstances into account.

You should not act on any of the above without specific advice.

To make the best investment decision for you and your super, make sure you seek professional advice from an expert.