An estimated 570,000 apartments are needed over the next three years across Australia’s capital cities, but only 55,000 apartments are currently being built each year, according to real estate investment firm CBRE.

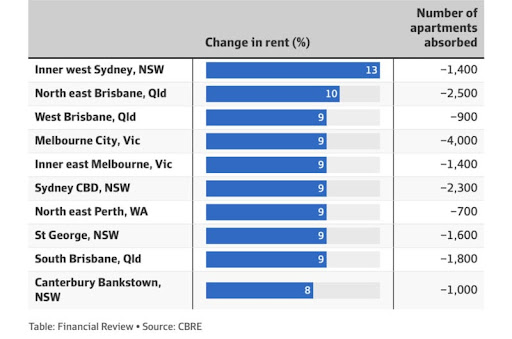

And that severe shortage is predicted to translate to price increases of up to 13% in Sydney’s inner west.

Rental demand is expected to climb by 34,100 in Sydney next year, fuelled by strong population growth, but there are only 15,300 apartments which means a shortfall of 18,800 units, CBRE’s estimates.

The average rent for units in inner west Sydney is currently around $694 after rising by 21.5% in the past 12 months or the equivalent of $123 per week, according to CoreLogic.

This is due to tighter vacancy rates - to 1.3% from 1.9% 12 months ago.

In Melbourne, the rental market will have a shortfall of around 23,800 apartments while Brisbane is expected to be around 12,100 short, Perth 10,500 short and Adelaide units short by 4,100.

Behind Sydney, the second-highest area where rental prices are expected to jump is in northeast Brisbane, by a huge 10%, thanks to strong demand and short supply.

Many other inner-city districts across Sydney, Melbourne, Brisbane and Perth are expected to see rental prices rise by 9% over the same period.

Inner city districts where rents are set to surge in 2024

CBRE Pacific head of research, Sammer Chopra explained that low vacancy issues will be most acute in inner areas of major city centres and nearby city suburbs.

“In most precincts around Australia we’re expecting 0.2% to 0.5% apartment vacancy contraction in the next 12 months.”

- he told the AFR.

This comes at a time when 80% of precincts have a sub-1.5% vacancy and will be a key driver of future rental growth, he added.

Australia’s rental crisis is spiralling out of control

Ultra-low vacancy rates combined with a low supply of new dwellings, high demand and a rising population have created a perfect storm environment that has pushed Australia’s market into a rental crisis.

Not only that but there is no end in sight to the rental crisis… in fact, it’ll probably just get worse.

Here’s why.

Given the stark imbalance between supply and demand, it is unlikely there will be much relief for renters over the short- to medium-term with stock levels unlikely to increase substantially anytime soon.

Tenants are fast coming up against affordability constraints and many are looking at ways to pay less rent - and it's reshaping household formation.

It’s likely some tenants are now sacrificing the spare room or home office and re-forming share houses that disbanded throughout COVID in order to share the rental burden.

At the same time, demand for rental housing is likely to remain high as overseas migration, foreign students and domestic renters compete for scarce rental supply, adding further pressure on prices to jump higher.

The fact is that while the federal government continues to lift our migration intake rate, Australia will forever suffer from housing (and rental) shortages.

The Intergenerational Report projected that Australia’s population will grow by 13.1 million people (50%) in only 40 years on the back of net overseas migration of 235,000 a year - that’s the equivalent of Sydney, Melbourne and Brisbane combined.

Some say the rental crisis is self-inflicted due to extremely high levels of immigration.

And there is no plan to slow down.

And government attempts at intervention are only making matters worse…

Instead of tackling the issue of population or poor supply, current policies have a different tact.

And they aren’t supportive of attracting more private property investors to supply rental accommodation.

The new government policies won’t even tackle half the issue, while some might even make it worse, such as the Green party’s proposed rental freeze or cap which is likely to only create poorer quality housing as landlords slow spending on upkeep, and less of it.

A final note for investors

While the current property market might not be attractive for investors right now due to high costs, government interventions and low supply of property for sale, it’s important to remember that property investment is a long-term game.

Don’t make 30-year investment decisions based on the last 30 minutes or even the last 30 days of news.

Instead, focus on buying an investment-grade property in an A-grade location and holding them for the long term.

These types of properties are in short supply but are still selling for reasonably good prices.

Plus they’ll hold their value far better in the long term.

While it might feel counterintuitive to buy when there are so many mixed messages out there, remember the rental crisis is only worsening further, with no end in sight.

Now would be a great time to buy an investment property and enjoy high demand while trying to be a part of the rental crisis solution.

Maybe others might follow in your footsteps.